What are Digital Assets?

Source blog.iota.org

Digital assets refer to intangible assets or resources that exist in digital form. These can include online accounts, digital currencies, and digital files. Online accounts may consist of social media profiles, email accounts, and cloud storage services. Digital currencies like Bitcoin and Ethereum are forms of digital assets that can be used for online transactions. Additionally, digital files encompass a wide range of content such as documents, photos, videos, music, and more.

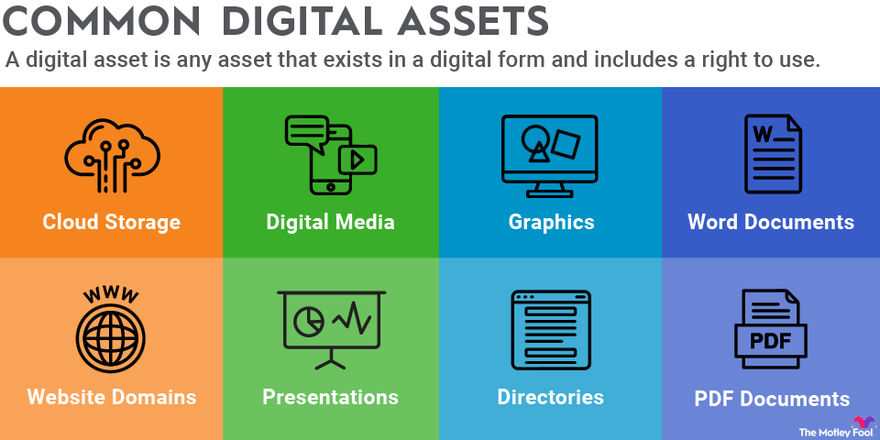

Types of Digital Assets

Source dailytradealert.com

When it comes to digital assets, there are several types that people may own or use. Let's take a closer look at some of the most common ones.

Cryptocurrencies are digital assets that exist only in electronic form and utilize cryptography for security. Examples of popular cryptocurrencies include Bitcoin, Ethereum, and Ripple. These digital assets can be used for online transactions, investments, or as a medium of exchange.

Online accounts, such as email, social media, and financial accounts, are another type of digital asset. These accounts contain personal information and data that should be kept secure to prevent unauthorized access. It's important to use strong passwords and enable two-factor authentication to protect these assets.

Digital documents, such as contracts, agreements, and certificates, are important digital assets that need to be stored and managed carefully. Using cloud storage or digital document management systems can help ensure that these documents are secure and easily accessible when needed.

Multimedia files, including images, videos, and music, are popular digital assets that people create and share online. These files can be stored on various devices or platforms, such as smartphones, computers, or cloud storage services. It's essential to back up these files regularly to prevent data loss.

Overall, digital assets play a significant role in our daily lives, and it's crucial to understand how to manage and protect them effectively.

Benefits of Investing in Digital Assets

Source blog.iota.org

Investing in digital assets can offer a range of benefits that differ from traditional investments. One of the main advantages is diversification. Digital assets include a wide variety of options such as cryptocurrencies, tokens, and digital securities. By adding digital assets to your investment portfolio, you can reduce overall risk and increase the potential for higher returns.

Additionally, investing in digital assets can provide the potential for significant returns. The digital asset market is known for its volatility, which means that savvy investors have the opportunity to capitalize on price fluctuations and generate substantial profits. While this volatility can be a risk factor, it also presents a unique opportunity for investors looking to grow their wealth quickly.

Another key benefit of investing in digital assets is the easy accessibility they offer. Unlike traditional assets that may require a broker or investment firm to manage, digital assets can be easily traded online using a variety of platforms. This accessibility makes it simple for investors to buy, sell, and track their digital asset investments in real-time, without the need for excessive paperwork or third-party involvement.

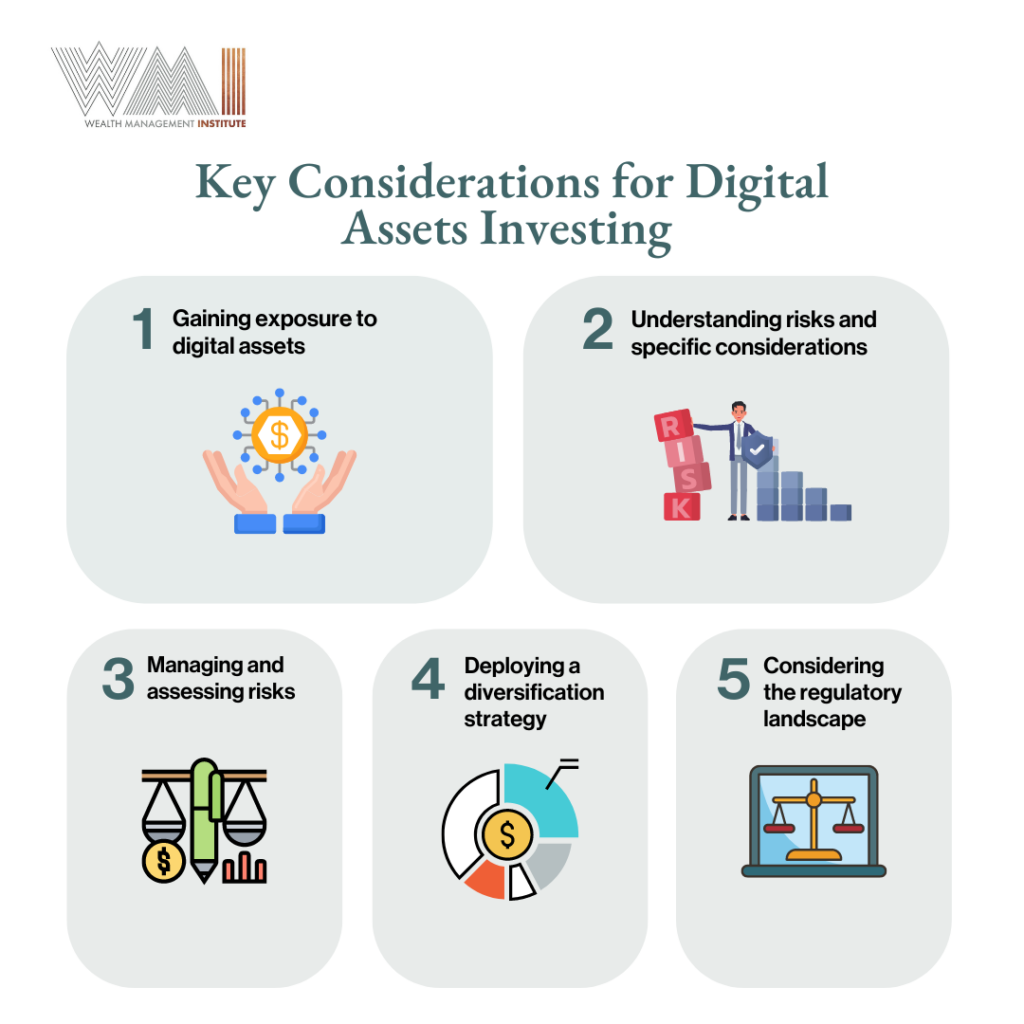

Risks of Investing in Digital Assets

Source wmi.edu.sg

Investing in digital assets can be lucrative, but it comes with its fair share of risks. Understanding and managing these risks is essential for any investor looking to enter the world of cryptocurrency and digital assets. Here are some of the key risks associated with investing in digital assets:

1. Market Volatility: One of the most well-known risks of investing in digital assets is market volatility. Prices of cryptocurrencies like Bitcoin and Ethereum can fluctuate wildly in a short period of time, leading to significant gains or losses for investors. This volatility can be caused by various factors such as market speculation, regulatory announcements, or macroeconomic events.

2. Regulatory Uncertainty: The regulatory environment for digital assets is constantly evolving and can vary significantly from one jurisdiction to another. Regulatory uncertainty can impact the value of digital assets and create legal risks for investors. Changes in regulations related to taxation, trading, or issuance of digital assets can have a significant impact on the market and investor sentiment.

3. Cybersecurity Threats: Digital assets are stored and transacted online, making them vulnerable to cyberattacks and theft. Hackers can target cryptocurrency exchanges, wallets, and other infrastructure to steal funds or compromise the security of the network. Investors need to take measures to secure their digital assets through secure wallets, two-factor authentication, and other cybersecurity practices.

4. Technological Risks: The technology underlying digital assets, such as blockchain, is still relatively new and evolving. There are risks associated with bugs, security vulnerabilities, and scalability issues in blockchain networks that can impact the value and usability of digital assets. Investing in digital assets requires understanding the technological risks involved and staying informed about developments in blockchain technology.

How to Start Investing in Digital Assets

Source blog.iota.org

Investing in digital assets has become increasingly popular in recent years, with the rise of cryptocurrencies like Bitcoin and Ethereum. For those looking to dip their toes into the world of digital assets, there are a few key steps to get started.

The first step is to open a digital wallet, which is essential for storing, sending, and receiving digital currencies. There are many different types of digital wallets available, ranging from software wallets that can be downloaded to your computer or mobile device, to hardware wallets that provide an extra layer of security by storing your assets offline.

Once you have a digital wallet set up, the next step is to choose a reputable exchange where you can buy and sell digital assets. It's important to do your research and select an exchange with a good reputation, strong security measures, and a user-friendly interface. Some popular exchanges include Coinbase, Binance, and Kraken.

Before diving in and investing your hard-earned money, it's crucial to research the digital assets you're interested in. This includes understanding the technology behind the asset, its use case, and the team behind the project. It's also a good idea to keep up to date with the latest news and developments in the world of digital assets, as these can have a significant impact on the value of your investments.

Lastly, it's important to consider the risks involved in investing in digital assets. The market can be highly volatile, with prices often experiencing large fluctuations in a short period of time. It's essential to only invest money that you can afford to lose and to diversify your portfolio to reduce your risk exposure.

By following these steps and approaching investing in digital assets with caution and diligence, individuals can start building their digital asset portfolio and potentially earn significant returns in the exciting world of digital assets.

Post a Comment for "Digital assets"