What is a Real Estate Investment Trust (REIT)?

Source arrived.com

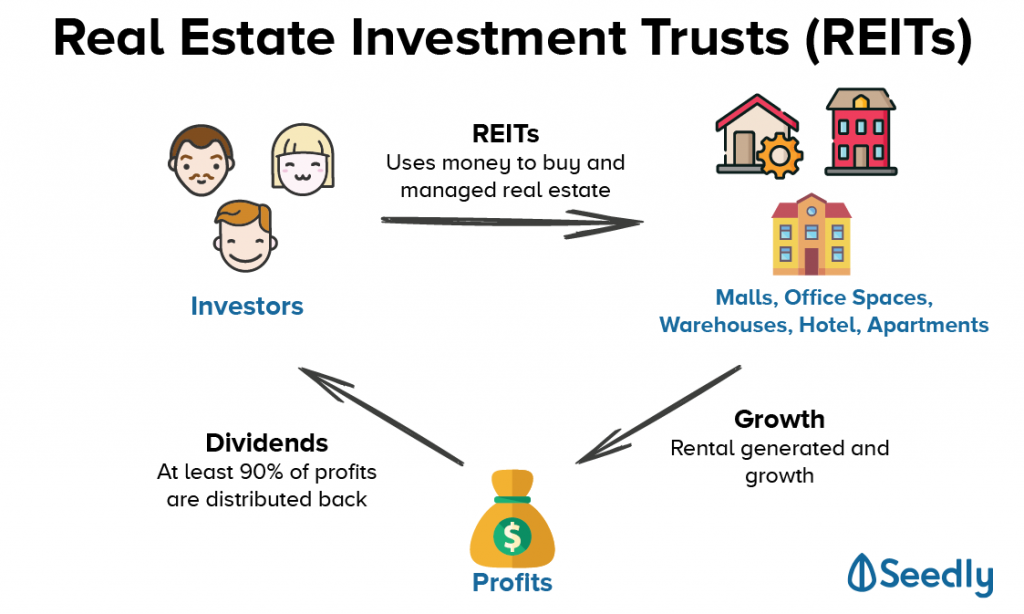

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate. REITs allow individual investors to earn a share of the income produced through real estate ownership without having to buy and manage properties directly. They are often compared to mutual funds but for real estate.

REITs can invest in a variety of real estate sectors such as residential, commercial, retail, industrial, and healthcare properties. They must meet certain requirements to qualify as a REIT, such as distributing at least 90% of their taxable income to shareholders in the form of dividends. Due to these requirements, REITs are known for offering high dividend yields, making them a popular choice for income-oriented investors.

Investing in REITs can provide diversification to a portfolio as they often offer exposure to different types of real estate assets. They can also serve as a hedge against inflation since real estate tends to increase in value over time. Additionally, REITs are traded on major stock exchanges, providing investors with liquidity compared to investing directly in physical real estate properties.

Overall, REITs can be a valuable addition to an investment portfolio for those looking to gain exposure to the real estate market without the hassle of property management. They offer income potential, diversification, and liquidity, making them a popular choice among investors seeking a combination of passive income and capital appreciation.

Types of REITs

Source moneymorning.com

When it comes to Real Estate Investment Trusts (REITs), there are three main types that investors can choose from. These types include equity REITs, mortgage REITs, and hybrid REITs. Let's dive deeper into each of these categories to understand their unique characteristics and investment opportunities.

1. Equity REITs: Equity REITs are the most common type of REITs. These trusts own and operate income-producing real estate properties. Investors who buy shares in equity REITs receive dividends from the rental income generated by these properties. Equity REITs can focus on various types of real estate, such as residential, commercial, industrial, or healthcare properties. Investing in equity REITs allows investors to benefit from the potential appreciation of real estate values and regular dividend payouts.

2. Mortgage REITs: Mortgage REITs, also known as mREITs, differ from equity REITs as they provide financing for real estate by investing in mortgages and mortgage-backed securities. Instead of owning physical properties, mortgage REITs earn income through the interest collected on the loans they provide to property owners. These REITs are more sensitive to changes in interest rates and economic conditions, as they rely heavily on the performance of the mortgage market. Investors in mortgage REITs can benefit from higher dividend yields, but they also face higher risks due to the fluctuations in interest rates and credit markets.

3. Hybrid REITs: Hybrid REITs combine the features of both equity and mortgage REITs, offering investors a diversified portfolio of real estate properties and mortgage investments. These trusts invest in a mix of physical properties and mortgage securities, providing a balanced approach to income generation and risk management. Hybrid REITs can offer investors the opportunity to benefit from both rental income and interest income, resulting in a potentially more stable and resilient investment option. However, it's essential for investors to understand the specific allocation and strategies of each hybrid REIT to assess their risk and return profile accurately.

Overall, the choice of REIT type depends on an investor's risk tolerance, investment goals, and market outlook. By diversifying across different types of REITs, investors can create a well-rounded real estate portfolio that captures the benefits of both equity and debt investments in the real estate market.

Benefits of Investing in REITs

Source www.maxfieldrents.com

Real Estate Investment Trusts, or REITs, offer investors a unique opportunity to invest in real estate without having to buy, manage, or finance any properties themselves. There are several benefits to investing in REITs that make them an attractive option for both novice and experienced investors alike.

One of the primary benefits of investing in REITs is the regular income they provide. Most REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. This can result in a consistent and reliable stream of income for investors, making REITs a popular choice for those seeking passive income.

Another key advantage of investing in REITs is the diversification they offer. By investing in a REIT, investors gain exposure to a portfolio of properties across different sectors such as residential, commercial, retail, and healthcare. This diversification can help reduce the overall risk in an investor's portfolio, as it spreads out the potential impact of any one property performing poorly.

Additionally, investing in REITs can provide investors with the potential for capital appreciation. As the value of the properties held by a REIT appreciates over time, so too can the value of the REIT shares. This can result in capital gains for investors, in addition to the regular dividend income they receive.

Overall, investing in REITs can be a valuable addition to an investor's portfolio, offering a combination of regular income, diversification, and potential for capital appreciation. However, like any investment, it's important for investors to conduct thorough research and due diligence before investing in REITs to ensure they align with their investment goals and risk tolerance.

Risks of Investing in REITs

Source sias.org.sg

While Real Estate Investment Trusts (REITs) can be a beneficial addition to any investment portfolio, it's important to understand the risks associated with investing in them. Here are some key risks to consider:

Interest Rate Risk: One of the primary risks of investing in REITs is interest rate risk. REITs are sensitive to changes in interest rates, as they often rely on debt to finance their real estate investments. When interest rates rise, the cost of borrowing increases, which can lead to higher expenses for REITs and lower returns for investors. On the other hand, when interest rates fall, REITs may benefit from lower borrowing costs, potentially resulting in higher returns for investors.

Real Estate Market Fluctuations: Another risk to be aware of when investing in REITs is real estate market fluctuations. The value of the properties owned by REITs can be affected by changes in the real estate market, such as fluctuations in property values, rental rates, and occupancy levels. Economic downturns or local market conditions can also impact the performance of REITs, potentially leading to declines in dividends and share prices.

Regulatory Changes: Regulatory changes can also pose a risk to REIT investors. REITs are subject to regulations that govern their structure, operations, and tax treatment. Changes in tax laws or regulations related to real estate investing can impact the profitability of REITs and the returns received by investors. It's important for investors to stay informed about regulatory developments that could affect their REIT investments.

Liquidity Risk: Another risk associated with investing in REITs is liquidity risk. Unlike traditional stocks, which are traded on stock exchanges and can be easily bought and sold, REITs may have lower trading volumes and less liquidity. This can make it more difficult for investors to buy or sell shares of REITs at desired prices, especially during times of market volatility.

In conclusion, while REITs can offer attractive returns and diversification benefits, investors should be aware of the risks involved. By understanding and carefully considering these risks, investors can make informed decisions about including REITs in their investment portfolios.

How to Invest in REITs

Source crowdfunding-platforms.com

Investing in Real Estate Investment Trusts (REITs) can be a great way to add diversification and passive income to your investment portfolio. There are several ways that investors can invest in REITs, ranging from buying individual REIT stocks to participating in private REIT offerings.

1. Buy Individual REIT Stocks: One way to invest in REITs is to buy individual REIT stocks through a brokerage account. This allows investors to choose which specific REITs they want to invest in based on their investment goals and risk tolerance. It's important to do thorough research on individual REITs before making a purchase, as each REIT may have different properties and management strategies.

2. Invest in REIT Mutual Funds or ETFs: Another option for investing in REITs is to invest in REIT mutual funds or exchange-traded funds (ETFs). These funds pool together money from multiple investors to purchase a diversified portfolio of REIT stocks. This can be a convenient option for investors who want exposure to the real estate market without having to research individual REITs.

3. Participate in Private REIT Offerings: For accredited investors, there is also the option to participate in private REIT offerings. These offerings are not publicly traded and are typically only available to high-net-worth individuals. Private REITs may offer higher potential returns but also come with higher risks and less liquidity compared to publicly traded REITs.

4. Consider the Risks and Rewards: As with any investment, there are risks and rewards associated with investing in REITs. While REITs can provide a steady stream of passive income through dividends, they are also subject to market fluctuations and interest rate changes. It's important to carefully consider your investment goals and risk tolerance before investing in REITs.

5. Consult with a Financial Advisor: Before investing in REITs, it's a good idea to consult with a financial advisor who can help you assess your investment goals and make a plan that aligns with your financial situation. A financial advisor can also provide guidance on the different types of REIT investments available and help you make informed decisions based on your individual needs.

Post a Comment for "Real Estate Investment Trust (REIT)"